C-PACE: A Low-Risk Investment Opportunity to Enhance Energy Efficiency in Commercial Buildings

As an early adopter and large investor in the Property Assessed Clean Energy (PACE) program, Amalgamated Bank brings expertise, agility and a nuanced approach to this financing tool that empowers energy efficiency upgrades for buildings through a low-risk investment structure.

What is PACE?

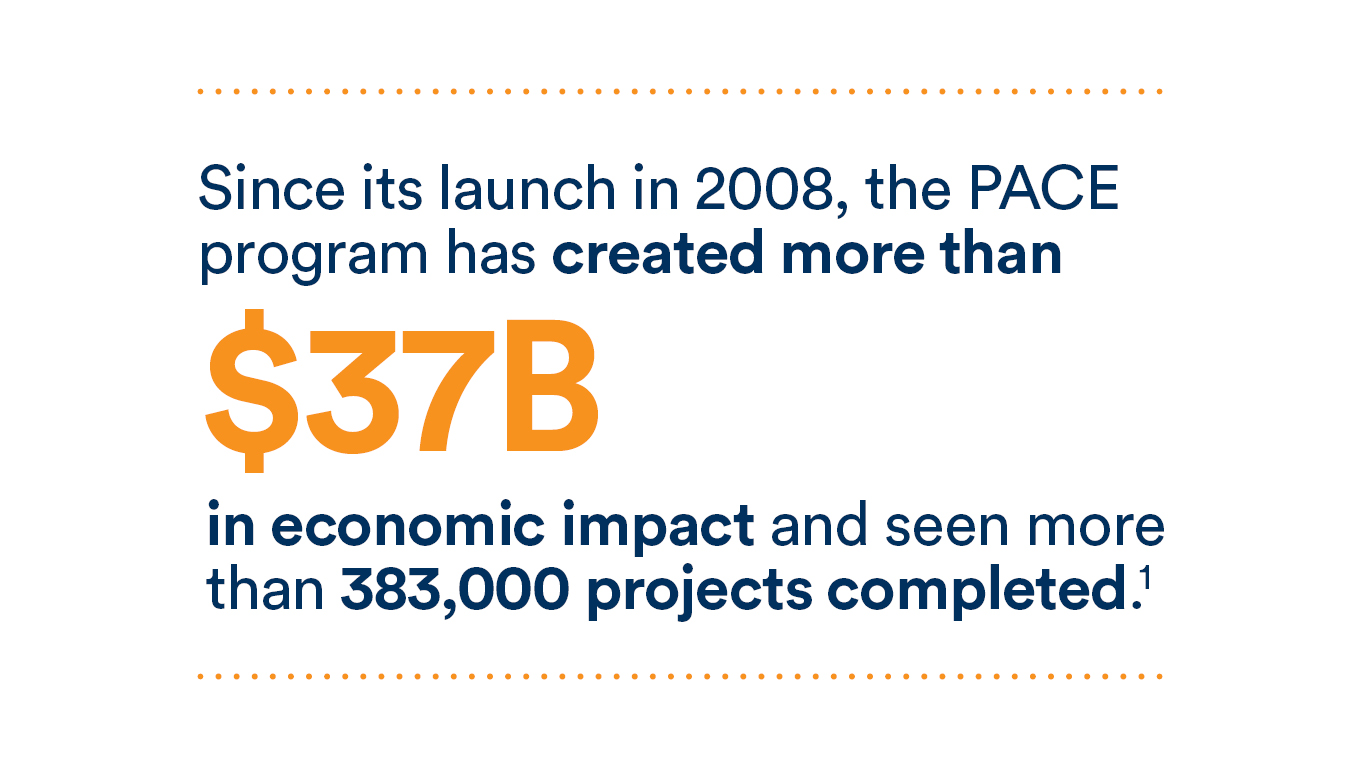

A financing tool designed to enable property owners to make homes and commercial buildings more efficient and resilient, Property Assessed Clean Energy (PACE) financing funds energy-efficiency improvements such as HVAC, lighting, and window upgrades, improved controls and motion detectors, and solar energy systems. Since its launch in 2008, the PACE program has created more than $37 billion in economic impact and seen more than 383,000 projects completed.

Both Residential PACE (R-PACE) and Commercial PACE (C-PACE) offer long-term fixed-rate financing for new construction, rehab projects, and retrofits. Unlike typical construction loans, which require the building owner to provide 20% to 30% equity, PACE covers 100% of the cost for eligible improvements, decreasing the need for equity or construction financing. This lowers the overall cost and enables building owners to make energy efficiency enhancements that they may not otherwise be able to finance.

C-PACE also enables commercial building owners to finance efficiency enhancements without disturbing existing first mortgages. For example, if the owner of a skyscraper with a first mortgage worth hundreds of millions of dollars wants to do a $10 million renovation of that building, C-PACE can finance the project without refinancing or disturbing the mortgage. That means less cost and a much less onerous approval process.

What Makes PACE Unique?

PACE financing utilizes legislation that allows building owners to finance the eligible improvements through voluntary tax assessments. The cost of the improvements is amortized over their useful life, generally up to 25 years, and the installment payments are added to the owner’s property tax bill. Like property taxes, C-PACE assessments run with the property rather than being an obligation of an individual. If the property is sold, PACE assessments may transfer to the new owner(s).

From an investor perspective, PACE assets provide an incredibly low-risk investment. This is because of the superior priority that PACE assessments have in the property lien structure. Because they are generally pari passu with the real estate taxes, they are in front of any first mortgages or other debt on the property, providing an extremely strong collateral position.

Part of the success of PACE programs is that they don't utilize government funds. PACE assessments are entirely financed through private capital providers and investors. Amalgamated Bank has been a longtime capital provider for PACE loans, with about $1.2 billion in PACE investments on its balance sheet, including just under a billion dollars in its R-PACE portfolio and about $270 million in its C-PACE portfolio.

Poised for Growth

The nuances of C-PACE are not well understood in the marketplace. PACE is a unique financing mechanism with a complex structure and significant differences from a traditional real estate loan. PACE assessments are essentially mini-bonds tied to the property (as opposed to an obligation of an individual or company) that can be bonded, securitized, rated and traded like common securities. These unique features are a departure from typical commercial real estate mortgages building owners and potential investors are familiar with and has led to a slower adoption of PACE than might otherwise be expected.

Yet, while PACE has been around since the early 2000s, the last few years have seen a significant growth in scale of C-PACE from large multinational financial institutions and the investment community. C-PACE legislation is currently active in 40 states plus Washington, D.C. Growth in C-PACE has been increasing as cities mandate energy-efficiency standards for commercial buildings and states struggle to meet renewable portfolio standards around decarbonization and electrification. Many of these changes are being required and enforced through fines and new building codes, with penalties set to increase over time.

Energy-efficiency improvements eligible for PACE financing are essential to meet growing demands around energy efficiency and decarbonization. For these reasons, Amalgamated Bank is bullish on PACE as an asset class and expects to continue expanding its C-PACE portfolio and is working to bolster supportive policy around PACE.

Learn More

Given the need to meet the country’s growing energy demands and accelerate the transition to renewables, PACE financing is uniquely situated to answer the moment. Amalgamated will continue to be a leader in the industry, assisting developers, architects, engineers, and property owners in learning more about this valuable tool.

Mobile Image

Mobile Image

Mobile Image

Mobile Image

Mobile Image

Mobile Image